Discount Rate for Actuarial Valuations of Employee Benefits (September 2015)

Discount Rate for Actuarial Valuations of Employee Benefits (September 2015)

The discount rate used in actuarial valuations of employee benefit plans such as gratuity, pension, earned leave etc. is determined by reference to market yields at the balance sheet date on government bonds (refer Para 78 of AS15).

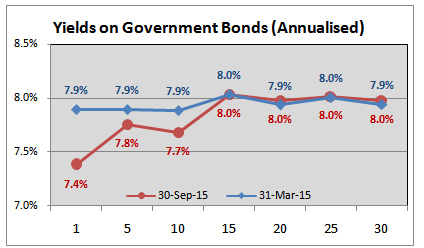

This means that these valuations are essentially Mark-To-Market (MTM) valuations, which can result in fluctuations in the valuation of liability if the underlying yield on government bonds fluctuates. As can be seen from the below analysis, the yield on the government bonds as at 30 September 2015 have fallen compared to yields as at 31 March 2015.

Bond Yields as at September 2015 and March 2015

Yields on the government bonds have fallen during the first half of this financial year for bonds with outstanding term to maturity of less than 15 years. For longer term bonds, the yields have broadly remained same.

The chart below presents the comparison of government bond yields of various terms as at 30 September 2015 and 31 March 2015. This information can be used to determine the discount rate to be used for actuarial valuation as per AS15.

*Please note that the yields provided in chart above are interpolated yields in cases where a bond of exact term to maturity is not available. Please note that the government bond yields are quoted on semi-annual basis and yields in above chart have been annualised

The likely impact of fall in Bond Yields

As you shall notice, the yields on shorter term bonds (i.e. bonds with term of less than 15 years) as at 30September 2015 have fallen compared to 31 March 2015. For longer term bonds (15 years and above), the yields have largely remained same.

This fall in bond yields of shorter duration will translate into a fall in discount rate used in actuarial valuations, which in-turn is likely to result in some actuarial loss due to change in assumptions and hence a marginal increase in valuation of liability. The increase in liability because of the above fall in yields is likely to be less than 2% to 3% of opening liability.

Kindly note that the discount rate is not likely to fall in case of companies with expected remaining working life of 15 years or more (after adjusting for attrition and deaths). Hence, such companies may not experience any increase in liability.

Consistent movement in Salary Growth Rate

In each of our discount rate updates, we have been recommending a consistent movement in the discount rate and salary growth rate to reflect the positive correlation between the inflation component of salary growth rate assumption and the discount rate.

Such a movement is also in line with the requirements of Para 76 of AS15, which reads as under:

"Actuarial assumptions are mutually compatible if they reflect the economic relationships between factors such as inflation, rates of salary increase, the return on plan assets and discount rates. For example, all assumptions which depend on a particular inflation level (such as assumptions about interest rates and salary and benefit increases) in any given future period assume the same inflation level in that period.â€

The Companies may, thus, consider changing the salary growth rate by a similar magnitude as is the movement in discount rate. This will help in offsetting the one off impact on account of fluctuation in the discount rate. Further, this will also help the Companies in maintaining a constant level of real salary growth rate assumed in projections from one valuation to another.

I trust you will find the observations and assertions in this note useful. I thank you for reading this note and welcome any comments or recommendations or observations you may have on the subject. You can direct those to the email address mentioned below.

Khushwant Pahwa, FIAI, FIA

Founder and Consulting Actuary

k.pahwa@kpac.co.in

+91-9910267727